modified business tax id nevada

Exceptions to this are employers of exempt organizations and employers with household employees only. What is the Modified Business Tax.

To get your Nevada Account Number and MBT Account Number register.

. However the Department will classify taxpayers when it discovers through account review audit a lead or other research that a company falls into one of the definitions under NRS 363A050. The majority of Nevada businesses will need to get a federal tax ID number. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

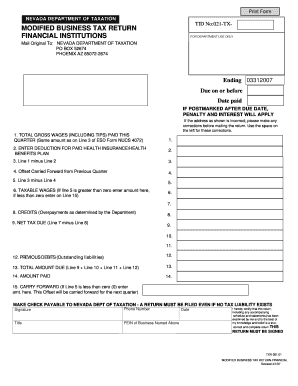

Baity Hill at Mason Farm Key Release Authorization Form Rev. Any employer who is required to pay a contribution to the Department of. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050.

What is the Modified Business Tax. Click a text box to optimize the text font size and other formats. A Nevada Employer is defined as per NRS 363B030.

There are no changes to the Commerce Tax credit. You must provide a valid Nevada Account Number and Modified Business Tax MBT Account Number to sign up for Square Payroll. Click Here for details.

Every employer who is subject to Nevada Unemployment Compensation Law NRS 612 is also subject to the Modified Business Tax on total gross wages less employee health care benefits paid by the employer. Nevada modified business tax form 2022ablets are in fact a ready business alternative to desktop and laptop computers. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter.

The New Business Checklist can provide you a quick summary of which licenses youll need estimated cost and time to obtain licensing. Find and click the Edit PDF tool. BUSINESS TAX TRANSFERABLE TAX CREDITS.

Tax Identification Number TID. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. Click and open the Adobe DC app on Windows.

Search by Business Name. If you need help with the Nevada Modified Business Tax Form or the Nevada Modified Business Return AMS Payroll 134 is the best product to try. Our payroll software makes data generation storage and application easy.

Modified Business Tax has two classifications. This number 9 digits long and unique to your company will serve as a unique identifier at the federal level not unlike a social security number SSN. Nevada Tax Center.

TID Taxpayer ID Search. Searching the TID will list the specific taxpayer being researched with its affiliated locations. MODIFIED BUSINESS TAX an institution or person who is licensed.

Who is subject to Nevada modified business tax. However the first 50000 of gross wages is not taxable. 43009 KEY RELEASE AUTHORIZATION FORM _____ _____ Resident Name BuildingApt.

Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount and general. Search by NV Business ID. Forgot your username or password.

Modified Business Tax NRS 463370 Gaming License Fees NRS 680B Insurance Fees and Taxes. This bill mandates all business entities to file a Commerce Tax return. Qualifying employers are able to apply for an abatement of 50 percent of the tax due during the initial four years of its operations.

Search by Business Name. Click the Select a File button and select a file to be edited. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

Operating without a Sales Tax Permit. General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after deduction of hEvalth benefits paid by the employer and certain wages paid to qualified veterans. To avoid duplicate registrations of businesses you are required to update your account with your Nevada Business ID example.

Nevada Business ID NVB ID. Effective July 1 2019 the tax rate changes to 1853 from 20. 99-9 9 digits Register for an EAN online at the DETRs Employer Self Service site to receive.

The easiest way to manage your business tax filings with the Nevada Department of Taxation. Dont Have a Nevada Account Number andor an MBT Account Number. The Department is now accepting credit card payments in Nevada Tax OLT.

Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Failure to remit Nevada Use Tax Modified Business Tax Tire Fees Live Entertainment Tax Liquor or Tobacco Taxes.

These numbers are required for us to make state tax payments and filings on your behalf. Employers who pay employees in Nevada must register with the NV Department of Employment Training and Rehabilitation DETR for an Employer Account Number and Modified Business Tax MBT Account Number. For a new business the abatement of the Modified Business Tax applies to the number of new employees.

Or Sign Up Today. Messy andor incomplete data is the greatest problem facing most business owners and accountants during this process. Nevada DETR Employer Account Number.

NV20151234567 obtained from the Nevada Secretary of State. Search by Business Address. Log In or Sign Up to get started with managing your business and filings online.

The Tax IDentification number TID is the permit number issued by the Department. Select File Save or File Save As to keep your change updated for Modified Business Tax Return Nevada. Modified Business Tax is a self-reporting tax and you are responsible for properly characterizing your business as a Financial Institution or General Business.

Youll also hear it called an employer identification number or EIN. Register File and Pay Online with Nevada Tax. Film Credit NRS 360759.

Search by Permit Number TID Search by Address.

Taxation And Government Intervention 8 Chapter 8 Taxation

Self Inking State Seal Notary Stamp Online Notary Supply Acorn Sales Notary Notary Seal Notary Signing Agent

Nevada Corporate Donations America S Scholarship Konnection

Fillable Form 10 381 Arkansas Duplicate Title Application Form Fillable Forms Registration

La County Well Permit Fill Online Printable Fillable Blank Pdffiller